The concept of compound interest, or ‘interest on interest’, is that accumulated interest is added back onto your principal sum, with future interest calculations being carried out on the total of both the original principal and already-accrued interest. According to an article published in the Journal of Economic Education in 2016, less than one-third of the U.S. population comprehends how compound interest fundamentally works.

The idea of compound interest has been around a long time, with limited evidence suggesting ancient civilizations may even have known about it. At the Louvre in Paris, there exists a clay tablet from Babylon, possibly dating from between 2000 to 1700 B.C., which appears to show a compound interest problem. However, it seems likely that it wasn’t until medieval times that mathematicians began to analyse compound interest fully.

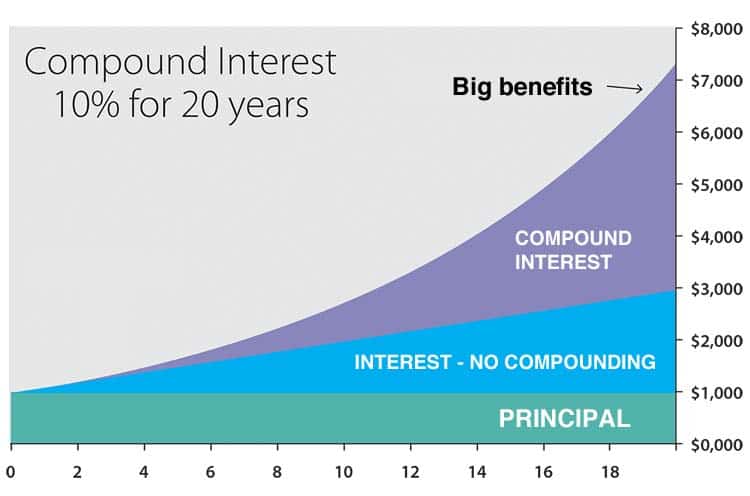

The power of compound interest really becomes apparent when you look at a chart of long-term growth. Here’s an example chart of an initial $1000 investment. We’ll use a longer compounding investment period (20 years) at 10% per year, to keep the sum simple. As we compare the benefits of compound interest versus standard interest and no interest at all, it’s clear to see how compound interest can help boost your investment value.

Compound interest example

Let’s look at a simple example baset on our YTD returns, and let’s say you have :

$5,000 in your saving account.

earning 60% interest per year.

Your first 5 years might look like this: $52 429

The power of compound interest can help you achieve even Higher interest rewards Looking back at the example above, if we were to contribute an additional $100 per month into our investment, your balance after 5 years would hit the heights of $77 124

How to Calculate Compound Interest !

Use our compound interest calculator to see how the power of compound interest can grow your savings or investments over time. Simulate your investments